The future of music retail is uncertain. That phrase has echoed across the industry over the past few years, and nowhere is it more clear than in the candid conversations from The Acoustic Shoppe Knows Things podcast. where the facts aren't sugarcoated of the challenges facing manufacturers, retailers, and even consumers. The industry is chaotic, a “dumpster fire,” and a storm of instability. But underneath the stress, there is also opportunity—an industry correction that could lead to better value, stronger partnerships, and healthier growth.

From Pandemic Panic to Unprecedented Booms

To understand the effect of covid-19 on the music retail industry, you have to look back. In early 2020, as the COVID-19 pandemic spread, sales collapsed. Shops closed, manufacturers halted production, and nobody knew if the market would survive. But by mid-year, something unexpected happened: a boom in hobbies. People stuck at home picked up guitars, mandolins, and other instruments. Suddenly, demand was overwhelming, and by 2021, instruments were selling out the day they arrived.

This spike in sales encouraged manufacturers to scale up, raise prices, and in some cases, shift toward direct-to-consumer strategies. But the bubble didn’t last.

The Crash: Oversupply Meets Declining Demand

By 2022, shipments of inexpensive instruments ordered during the boom began flooding stores—at the exact moment demand cooled. Meanwhile, the used market swelled with instruments from beginners who gave up. The result? An oversaturated, unbalanced market.

Manufacturers who had thrived on boutique, high-end builds suddenly found themselves holding massive amounts of inventory. Prices on $7,000–$10,000 guitars, once justified by surging demand, were no longer sustainable. The hosts noted that many brands are now being forced to rethink their customer base, product strategy, and even their entire business models.

Stress Between Manufacturers and Retailers

Another reason the future of music retail is uncertain is the changing dynamic between builders and shops. During the boom, some companies deprioritized dealers, focusing instead on direct sales. Now, with inventory piling up, those same manufacturers are returning to retailers—but often with confusing or contradictory expectations.

One week, a brand may pressure a dealer to run more marketing; the next, it criticizes them for running campaigns without approval. Some even use old-school tactics, threatening to add new dealerships unless sales increase. This tug-of-war creates friction and anxiety across the supply chain.

Industry Aging and Structural Shifts

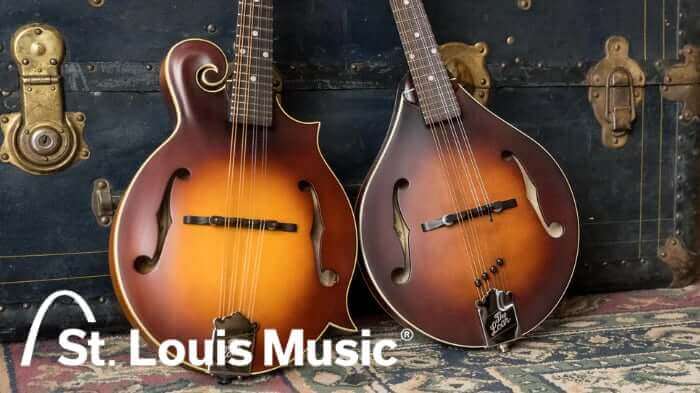

One thing to highlight is the generational changes reshaping the landscape. Longtime leaders are retiring—names like Tom Bedell and other respected figures have stepped back, leaving uncertainty for major brands. Acquisitions, such as Recording King’s move under St. Louis Music, and the restructuring of giants like Sam Ash, signal how volatile the market has become.

At the same time, demographics are shifting. Population growth is slowing worldwide, meaning fewer future consumers. The baby boomer generation, once a powerful driver of hobby markets like music, is aging out. For an industry that relies on new players picking up instruments, this trend raises serious concerns.

Why Correction Could Be Good

Despite the turbulence, the industry is experiencing a necessary correction. And while the future of music retail is uncertain, that doesn’t mean it’s bleak.

Emphasizing a return to sell-through—understanding what customers actually want and ensuring those instruments get into their hands. Instead of overproducing or chasing inflated price points, manufacturers will need to meet players where they are: delivering quality, accessible instruments that balance affordability with craftsmanship.

For consumers, this means better value. As the market stabilizes, buyers can expect instruments with higher quality control, stronger warranties, and more thoughtful design. For retailers, it signals a return to collaboration, as manufacturers recognize the vital role shops play in education, service, and community building.

Looking Forward: Collaboration and Value

The uncertainty in music retail is real. The Acoustic Shoppe has many sleepless nights, mixed signals from manufacturers, and the constant push-and-pull of a turbulent market. The Shoppe has to remain optimistic. More brands are reaching out for collaboration, inviting retailers to test instruments early, film demos, and provide feedback.

If these partnerships are executed well, the result could be a healthier, more sustainable industry. Customers will benefit from improved quality and better value, while shops and manufacturers rebuild stronger, more transparent relationships.

One of the most important aspects of the Yamaha Atmosfeel pickup system is how it adapts to different playing situations without requiring endless adjustments. Many pickup systems sound good in a controlled studio environment but struggle to translate naturally on stage, especially in louder band settings where feedback can be an issue. Atmosfeel minimizes these challenges by combining microphone detail with undersaddle pickup clarity, ensuring that a guitarist can move confidently between the studio and the stage. This consistency is a game-changer for working musicians who need reliability night after night and highlights how Yamaha is shaping the future of music retail by focusing on real-world solutions.

Another benefit worth noting is the user-friendly nature of the controls. Instead of overwhelming players with complicated EQ settings, Yamaha designed the system with intuitive knobs that adjust bass, mic blend, and overall volume. This simplicity allows players to focus on their performance instead of getting lost in technical fine-tuning. For singer-songwriters, worship musicians, and performers who need quick adjustments on the fly, this design philosophy makes a noticeable difference. It’s another example of how the future of music retail will depend on brands creating gear that makes life easier for musicians without compromising on tone.

Finally, the Atmosfeel system represents a broader trend in the music industry—brands recognizing that musicians need more than just quality tonewoods and craftsmanship. They need tools that enhance creativity, cut down on setup time, and help them sound their best in real-world scenarios. Yamaha’s investment in innovative electronics like Atmosfeel shows how the company is not only preserving tradition but also preparing for the future of music retail, where players expect instruments that are stage-ready straight out of the case.

Final Thoughts

The future of music retail is uncertain, but uncertainty can be the beginning of transformation. Just as the industry survived past recessions, wars, and shifts, it will survive this correction. The difference this time is speed—the swings from panic to boom to slowdown have happened faster than ever before.

But out of the turbulence comes opportunity: a chance to reset expectations, refocus on value, and rebuild the partnerships that keep music alive. For players, that means a brighter future with better instruments, more choice, and stronger support.